Healthcare Coverage for Filipinos

In the Philippines, out of 105 million citizens only 4 million or 4% are covered by a company sponsored medical plan. This means that 101 million Filipinos or 96% are left to fend for themselves. This is a far cry from other developed countries such as the United States where out of a population of 325 million citizens, 155 million or 48% are covered by a medical plan through their employer.

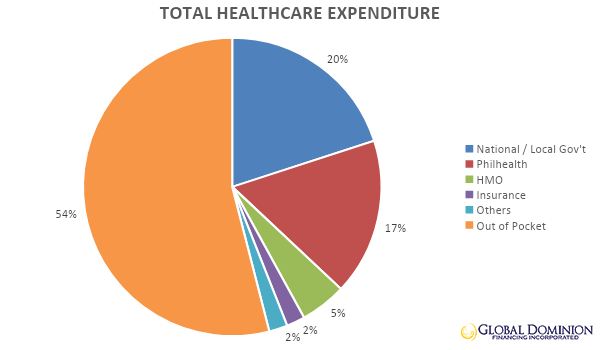

According to the department of health, healthcare expenditure in 2017 reached a staggering Php684 billion. Of this amount, Php373 billion or 54.5% were out of pocket expenses. This simply means that Filipinos still shoulder a large portion of healthcare expenses.¹ In the U.S., only 11% of their total health expenditure came from out of pocket expenses.

In a country where the average monthly family income is only Php22,000 ² (Results from the 2015 Family Income and Expenditure Survey by the PSA), costs related to unexpected or catastrophic illnesses can push a family to poverty.³ In fact, P4,000 per month in health-care expenses is already considered as catastrophic for single income families.

“High levels of out of pocket expenses is seen as regressive as families are forced to skimp on education and other important spending” – Atty. Dennis Funa, Commissioner – Insurance Commission

The reason for the extremely low rate of insured Filipinos has a lot to do with the individual mindset. Filipinos often view any form of insurance as an unnecessary expense. They would rather deal with any situation as it arises rather than properly prepare for it. They fail to realize that not preparing for it properly can be more costly. Often times during a medical emergency, families often have to borrow money from friends and relatives. In extreme situations, they resort to selling personal assets like property, jewelry, appliances, etc. or worse, they borrow money from informal lenders at exorbitant interest rates. These often lead to insurmountable debts, forcing some children to stop school in order to work and help earn extra money.

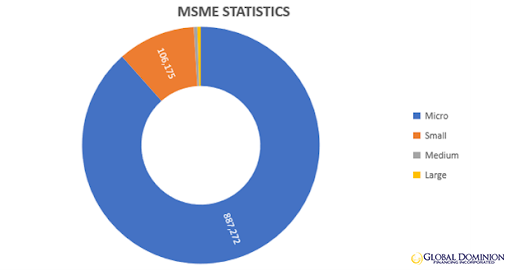

The Filipino SME is no different. They often view benefits such as healthcare and life insurance as a needless expense. This is quite unfortunate given that majority of business in the Philippines are SMEs. 4According to the DTI, we have 1,003,111businesses operating in the country. Of these, 998,342 (99.52%) are MSMEs. Together, these MSMEs employed a total of 5,714,262 workers compared to large enterprises that employed only 3,328,801.

If our SMEs start viewing benefits such as healthcare and life insurance as an investment rather than an expense, we might slowly see the number of insured Filipinos go up. And if these benefits are extended to the dependents of employees as well, then that number can go significantly higher.

The value and importance of our SMEs cannot be emphasized enough. They play an important role not only in the macro economic development of our country but in its social economic development as well.

Michael Galang, the author of this article, is the President and Chief Executive Officer of Intego Insurance Agency, a member of #TheConvergenceProject2020.

This gathering of different organizations from various sectors, mostly from the financial industry, seeks to elevate the level of financial literacy in the Philippines.

The Team: Global Dominion Financing Inc., Intego Insurance Agency, Sendah, Compass PH, SeedIn Technology, Loansolutions.Ph, KayaCredit

________________

1 https://en.wikipedia.org/wiki/Health_insurance_coverage_in_the_United_States

2 https://www.ceicdata.com/en/philippines/family-income-and-expenditure-survey-average-annual-

income-by-family-size-and-income-group/average-family-income-philippines-all-income-classes

3 https://businessmirror.com.ph/2019/06/19/the-health-insurance-gap-in-the-philippines/

4 https://www.dti.gov.ph/dti/index.php/2014-04-02-03-40-26/news-room/179-workshop-on-market-1

access-for-MSMe-set