The Reality of OFW Cashflow

In my line of work, I get to meet a lot of OFWs from all over the world. Looking from afar, it may seem that they are living the good life but behind those pictures of scenic views and romantic lights, it is seldom that people talk about the sacrifices that our loved ones from overseas go through.

In Compass PH, we have devoted our time and effort to help OFWs get back on their feet after going through some hardships. During that process, one would really get to know them. Everyone of our OFWs have their own reasons why they have ventured out into an unknown land. One thing I see in common though which is quite normal in our culture is the love for family.

Though it may be true that most of them earn more than us who chose to stay. The amount of income that they earn rarely get spent on themselves. A few recent conversations regarding this have made me curious on one thing. How is it that even though they earn a higher amount, more and more OFWs end up with nothing in the end.

In an article written by Chinkee Tan for Tempo last April 22, 2019, he enumerated 4 common OFW financial mistakes: (1) Spending to much on “pasalubong”, (2) Not Prioritizing savings, (3) Not setting financial goals and (4) Giving in to pressure of relatives’ requests.

A Filipina from Singapore told me that in the years that she has worked away from her family, one very important habit she has developed is focusing on the present. “Right now, my family needs food on their table. Right now, my children needs to go to school. Right now, I need to do this work.” This has served as one way to lessen her longing to be with her family but one wonders how this may have led to her ignoring the future. Although she says that she would want to save up for herself, what matters more to her is that she will be able to help her family’s current situation.

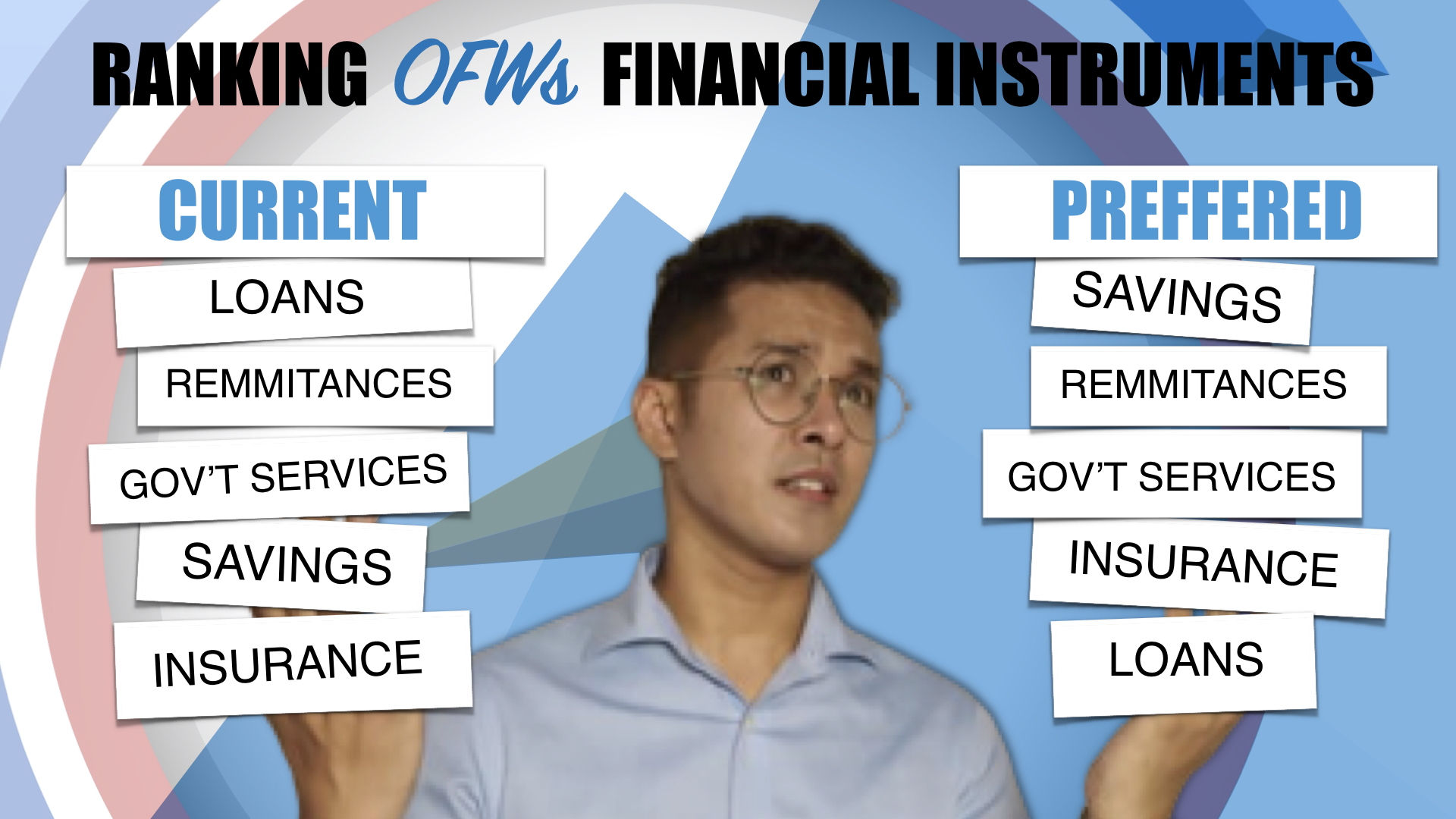

A recent survey we did was on what OFWs need/use to help their families. The top 5 that came up was (1) Loans, (2) Money Remittances, (3) Bank Savings (4) Government Services and (5) Insurance. After getting the top 5, we asked again what they use the most. At present, the average top answer was Loans. Followed by Remittances, Government Service, Bank Savings then Insurance. We asked again, if that is the order that they want. Average answer gave a different order. Savings came first. Followed by Remittances, Government Services, Insurance and Loans but only for emergencies.

Helping OFWs is the main goal of our organization. That is why, we are working on how to bring these 5 instruments closer to our modern heroes. We have brought and are continuously getting reliable partners so that OFWs can easily connect to them through the app. Our mission does not stop with helping OFWs come back to the country after a hardship. We would like to envision OFWs to be financially literate and be able to plan for the future in a home wherever. A home that is built under a strong foundation protected from anything that may happen.